When it comes to getting a mortgage, there’s no shortage of misinformation. Many homebuyers, especially…

💸 Rate Cut Pause

Issue 106 – Good Morning and Happy Tuesday.

A little bit of a roller coaster this week with rates. No major pop, but tariffs are scaring the bejesus out of the markets… then it’s okay… then they get spooked again, lol.

Meanwhile, we are trucking along. Purchase season has arrived and buyers are moving forward with pre-approvals and making offers.

Personal note: Rainy days most of the weekend. Kids were cooped up and we watched a few movies while I got some work done.

Friends 1994, NBC – Via Tenor

TLDR (Too Long Didn’t Read) Summary

-

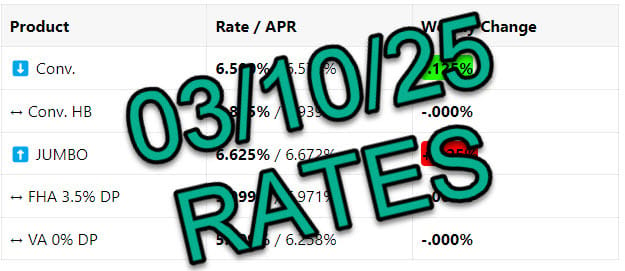

⬆️⬇️ RATES – Mixed Bag.

-

📊 INDUSTRY – Fed pauses rate cuts.

Sell Smarter with Fyxer AI

For busy property specialists, admin tasks can pile up fast.

Enter Fyxer, your AI Executive Assistant:

-

Emails organized and ready for your day.

-

Personalized replies crafted to match your tone.

-

Detailed notes from every meeting.

-

Spend less time on admin, more time on deals.

Try a 7-Day Free Trial—no credit card required! Integrates seamlessly with Gmail and Outlook.

INTEREST RATES

Rates 📢 February 4th, 2025

10 year 3-Month Snapshot

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

↔️ Conv. |

6.875% / 6.896% |

-.000% |

|

⬇️ Conv. HB |

7.000% / 7.067% |

-.125% |

|

⬆️ JUMBO |

6.875% / 6.932% |

+.250% |

|

⬆️ FHA 3.5% DP |

6.125% / 7.105% |

+.125% |

|

⬇️ VA 0% DP |

6.125% / 6.385% |

-.125% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: Mortgage rates fluctuated as markets reacted to economic uncertainty. A decline in stocks led to a bond rally, helping rates ease slightly. However, proposed 25% tariffs on Canadian and Mexican imports raised concerns about inflation, adding volatility.

Bottom Line: Looking ahead, upcoming jobs and inflation reports will be key in shaping rate movements. If data points to slowing growth, rates could decline further.

TECHNICALS

Rate Cut PAUSE

The Fed hit pause on rate cuts, home prices keep climbing, and new home sales are surging. Here’s how it all impacts you:

📉 Rates Hold Steady – The Fed kept rates at 4.25%-4.5%, signaling they won’t rush into further cuts. Mortgage rates remain around 6.95%, keeping affordability a challenge. Expect buyers to remain cautious, especially in higher-priced markets.

🏠 New Home Sales Boom – With low existing inventory, new home sales jumped 3.6% in December. Builders are filling the gap, but only 118K of the nearly 500K available homes are completed. Realtors should watch for builder incentives to attract hesitant buyers.

📉 Pending Sales Dip – After 4 months of growth, pending sales dropped 5.5% in December, hitting the Northeast and West hardest. High rates are slowing buyers in pricier areas, but more affordable regions are still moving. Sellers need to price competitively!

📈 Home Prices Hit New Highs – National prices rose 3.8% YoY, with major metros appreciating even faster. Great news for sellers sitting on equity! Buyers need to act before prices climb higher.

🔑 Bottom Line for Realtors:

-

Higher rates = affordability struggles. Get creative with rate buydowns or seller concessions to close deals.

-

New builds are hot. Leverage builder inventory to find homes for clients struggling with resale shortages.

-

Pricing strategy is key. Sellers in high-cost areas may need to adjust expectations to attract buyers.

📅 What’s Coming This Week: Key Reports to Watch

This week is packed with labor market data that could impact mortgage rates and buyer confidence. Here’s what to watch:

🔹 Tuesday, Feb 6 – Job Openings (JOLTS)

Tracks demand for workers, a key indicator of economic strength. A strong job market supports buyer confidence, while a slowdown could signal future rate cuts.

🔹 Wednesday, Feb 7 – ADP Private Payrolls

A sneak peek at job growth in the private sector. If hiring slows, rates may trend lower, helping affordability.

🔹 Thursday, Feb 8 – Jobless Claims

Weekly data on layoffs. Fewer claims = stronger economy = higher rates (and vice versa).

🔹 Friday, Feb 9 – Non-Farm Payrolls & Unemployment Rate

The big one! If job growth slows and unemployment rises, expect increased talk of Fed rate cuts. If the labor market stays strong, higher mortgage rates could stick around longer.

🔑 Why Realtors Should Care:

-

A cooling labor market could lead to lower mortgage rates, bringing hesitant buyers back.

-

A strong job market keeps demand steady but may delay Fed rate cuts, keeping rates elevated.

-

Watch these reports to advise clients on timing their purchase or sale.