Mortgage Rates Ease ⬇️, Rocket To Purchase Mr. Cooper, Decades Party, Inflation Close But No Cigar.

💸 Back In The Saddle

Issue 102 – Good Morning and Happy Tuesday.

The Wire, HBO 2002 via Tenor

We’re back! That was a pleasant 3 weeks off from the newsletter, but it’s time to get back in the saddle.

Markets stayed pretty stagnant through Christmas and New Year. On the bright side, the rates didn’t get any worse than where we left off in mid-December, but boy, we need to get back into the mid 6’s fast. These 7% rates are no fun!!

We’re entering jobs week. Reports are going to start on Wednesday and end on Friday with the BLS report. These BLS reports have been wildly inaccurate over the past months, but nonetheless, the markets react like the numbers are legit. So buckle up.

They do revise the BLS numbers eventually, but the damage gets done quickly when the numbers are not in our favor.

Personal note:

The boys had a great Christmas, and we had a quiet New Year. We got out last week and launched the Estes Rocket they got as a present—lots of anticipation and “WOW” moments.

Launching our rocket 1,000+ feet in the air!

Recovery was hit or miss. We had 5 successful launches and 3 successful recoveries over 2 days. A failed parachute deployment and snapped shock cord, leaving our nose cone floating a few miles away, were the highlights of the 2 failures. All great stories to tell later.

Post-launch

It’s Time To Rethink Your Media Diet

Financial news is full of clickbait and fear tactics, wasting your time and clouding your judgment. The Daily Upside delivers expert insights—free every morning. Join 1M+ readers today!

Join 1M+ readers for free today!

INTEREST RATES

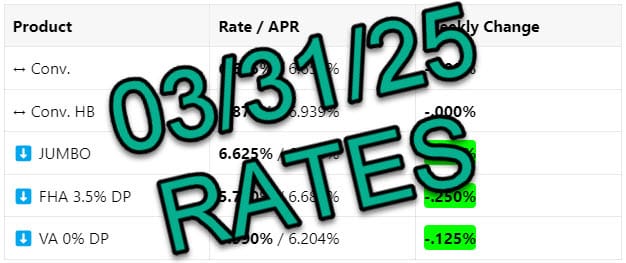

Rates 📢 January 7th, 2025

10 year 3-Month Snapshot

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

⬆️ Conv. |

7.000% / 7.015% |

+.125% |

|

⬆️ Conv. HB |

7.250% / 7.261% |

+.375% |

|

⬇️ JUMBO |

6.750% / 6.759% |

-.125% |

|

⬆️ FHA 3.5% DP |

6.250% / 7.179% |

+.125% |

|

⬆️ VA 0% DP |

6.250% / 6.465% |

+.125% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

We’re back!! I hope everyone had a healthy and happy holiday break.

Rates: Still making a steady upward march into the New Year.

Bottom Line: This week will see a lot of jobs data. We hope it will have a positive effect on the bond markets.

TIPS & TRICKS

How To: Waive VA Pest Section 1

One of the most common misconceptions about VA loans is that sellers must pay for all pest inspections and repairs. However, with the right knowledge and tools, you can simplify the process for your VA buyers and avoid unnecessary complications.

At GTG Financial, we’ve successfully completed dozens of VA transactions using the NPMA-33 form, a simple solution that can eliminate the need for a full pest report.

What Is the NPMA-33 Form?

The NPMA-33 is a standardized pest inspection form that certifies a property is free of active infestations. Rather than submitting a full pest inspection report, this form can be used to meet lender requirements and streamline the process.

Important Note: The NPMA-33 form must be filled out by the pest inspector who conducted the full inspection. This ensures that the property has been properly evaluated and meets VA loan requirements regarding pest infestations.

By utilizing the NPMA-33, VA buyers can avoid the need for a full pest inspection report and bypass the requirement to repair Section 1 items, as long as there are no active infestations.

Download the NPMA-33 form here.

VA Guidelines on Pest Inspections

According to the VA Lender’s Handbook, specifically Chapter 13, Section 13.06, lenders may accept the NPMA-33 form in lieu of a full pest inspection report, as long as there are no active infestations present. This allows for a more streamlined loan process for VA buyers, provided the form is completed by a licensed pest inspector.

For more details, you can review the guidelines directly in the VA Handbook here.

Key Considerations for Realtors:

While the NPMA-33 form simplifies the VA loan process, there are important factors to keep in mind:

-

No Active Infestation Required: The property must be free of termites or other active pest issues for the NPMA-33 to be acceptable. If an infestation is found, this form cannot be used, and a full pest inspection report, along with repairs, will likely be required.

-

Simplified Financing Process: Submitting the NPMA-33 form allows VA loans to move forward without the need for a full pest report, which can save time and prevent triggering costly Section 1 repairs. This can make the transaction smoother, especially for sellers concerned about the cost of repairs.

-

Not All Lenders Accept the NPMA-33 Form: It’s crucial to work with a VA-experienced lender or mortgage broker who is familiar with this process. Not all lenders accept the NPMA-33 in place of a full pest report, so it’s essential to ask your lending professional early in the transaction to ensure they accept it.

-

Visible Defects May Trigger a Full Report: Even if you submit the NPMA-33 form, be aware that if an appraiser identifies visible defects related to pest damage, a full pest report will likely be required, and all Section 1 items will need to be repaired. This is to ensure the property meets VA guidelines.

Appraiser finding a defect

-

Borrower Awareness Is Crucial: While this form can help simplify the financing process, it’s essential that the borrower is fully aware of the property’s condition. The NPMA-33 form doesn’t replace a thorough inspection of the property—it only addresses the financing side by waiving the need for a full pest report when no active infestations are present.

Conclusion

The NPMA-33 form is an effective tool to simplify the VA loan process and dispel the myth that sellers must cover pest-related expenses. With GTG Financial’s experience in handling dozens of VA transactions, we know how to help you streamline your next VA loan by using the NPMA-33. Just be sure to ask your lending professional if this form is accepted, and remember that visible defects noted by an appraiser can still trigger a full pest inspection and require all Section 1 repairs.

For more information, call us today and start streamlining your VA transactions today!