Mortgage Rates Ease ⬇️, Rocket To Purchase Mr. Cooper, Decades Party, Inflation Close But No Cigar.

💸 CPI Could Spur Bonds…

Issue 107 – Good Morning and Happy Tuesday.

Short and sweet this week. We MIGHT have some relief late this week with the CPI report and how that will affect the bond market, in turn, rates. In the meantime, no major movements over the last week, just small jocking back and forth.

Personal note: How satisfying was that to see the Chieft totally dismantled on Sunday? Would have loved a closer, more exciting game, but this was also a very good watch 😉

More personal stuff coming soon, I know I have been lacking, and you guys love the pictures of the boys!!

TLDR (Too Long Didn’t Read) Summary

-

↔️ RATES – Echoing Fed’s pause last week.

-

📊 INDUSTRY – Could we see rate relief late this week?

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

INTEREST RATES

Rates 📢 February 11th, 2025

10 year 3-Month Snapshot

|

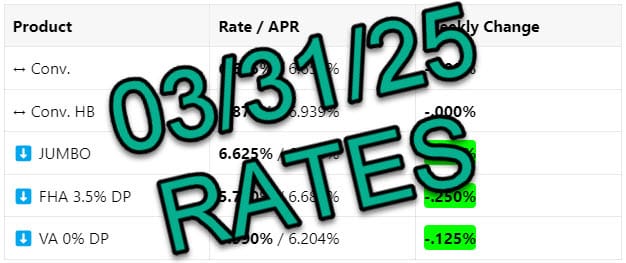

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

↔️ Conv. |

6.875% / 6.896% |

-.000% |

|

↔️ Conv. HB |

7.000% / 7.067% |

-.000% |

|

⬇️ JUMBO |

6.750% / 6.791% |

-.125% |

|

↔️ FHA 3.5% DP |

6.125% / 7.105% |

-.000% |

|

↔️ VA 0% DP |

6.125% / 6.385% |

-.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: This week’s Consumer Price Index (CPI) report will be a key driver for mortgage rates. Headline inflation is expected to stay around 2.9%, but the core reading may dip slightly due to easing shelter costs. If inflation comes in lower than expected, rates could improve. However, if CPI surprises to the upside, expect continued volatility. Wednesday’s 10-year Treasury auction will also impact rate movement. Stay tuned!

TECHNICALS

Relief On The Way?

📉 Rate Watch: What Realtors Need to Know

Mortgage rates faced mixed movement last week as labor data signaled both strength and weakness.

📊 Job Growth Slows, But Wages Rise – The economy added 143,000 jobs in January, falling short of expectations, but upward revisions from prior months offset the weakness. Wages increased 0.5% month-over-month, though a drop in hours worked softened the impact.

📉 Fewer Job Openings & Hiring Slows – December saw a steep drop in job openings, hitting a nearly four-year low. The hiring rate is now at its lowest in over a decade, excluding COVID, which could indicate a slowdown in economic momentum.

🏡 What This Means for Rates – Slower job growth and declining hiring trends could put downward pressure on mortgage rates if the Fed sees a cooling labor market as a reason to cut rates sooner. However, wage growth remains a wildcard, as rising incomes could keep inflation sticky.

📅 What’s Coming This Week: Key Reports to Watch

This week’s economic data could be a major catalyst for mortgage rates. Here’s what to keep an eye on:

📅 Wednesday – Consumer Price Index (CPI)

-

The most important inflation report of the month. If inflation comes in hot, rates may stay elevated. A cooler reading could bring some relief.

📅 Thursday – Producer Price Index (PPI) & Jobless Claims

-

PPI measures wholesale inflation, which can signal where consumer prices are headed.

-

Jobless claims will show if layoffs are increasing, which could pressure the Fed to ease rates sooner.

📅 Friday – Retail Sales

-

Consumer spending drives the economy. Strong sales could keep rates higher, while weak numbers would reinforce a slowing economy and potentially push rates lower.

Bottom Line: If inflation remains stubborn, expect little relief on rates. But if these reports show cooling prices and economic slowing, we could see some downward movement in mortgage rates.

Share GTG Weekly with colleagues and earn access to exclusive Monday morning rate updates directly to your inbox. Stay ahead of the curve!