Mortgage Rates HOLD ↔️. Labor Market Showing Cracks. Rocket Buying Redfin. VA Tips & Tricks.

💸 Momentum Building

Issue 105 – Good Morning and Happy Tuesday.

Wow, the weather recently has been short-lived during the day, but fantastic nevertheless. Mid to low 60s with clear skies and sunshine; sign me up!

Rates have been on a great track the last 2 weeks. We hope to see that continue as we start to see even more buyer activity.

Personal note: We had to say goodbye to a cherished member of the family, our Chocolate Lab, Riley. She was 13 and lived a whole, wonderful life. She will be missed, but not forgotten ❤️.

Riley 2012 – 2025

TLDR (Too Long Didn’t Read) Summary

-

⬇️ RATES – Trying to get back on track.

-

💡 TIPS & TRICKS – Are sellers required to pay VA fees?

-

📊 INDUSTRY – Home sales, 10-month High.

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

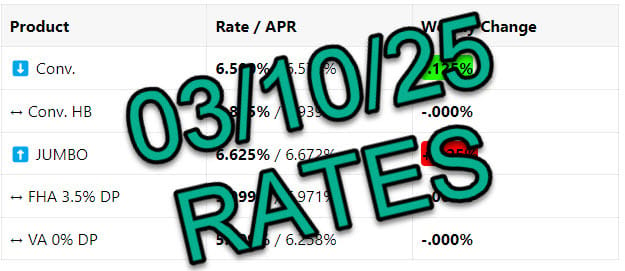

INTEREST RATES

Rates 📢 January 28th, 2025

10 year 3-Month Snapshot

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

⬇️ Conv. |

6.875% / 6.896% |

-.125% |

|

⬇️ Conv. HB |

7.125% / 7.140% |

-.125% |

|

⬇️ JUMBO |

6.625% / 6.643% |

-.125% |

|

⬇️ FHA 3.5% DP |

6.000% / 6.949% |

-.125% |

|

↔️ VA 0% DP |

6.250% / 6.482% |

-.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: Rates have dropped due to a “flight to safety,” as investors moved from risky assets like tech stocks into Mortgage Bonds. This shift was triggered by a decline in tech stocks after DeepSeek’s AI breakthrough and growing economic uncertainty, including slower hiring signals. Strong bond performance and tight housing supply metrics further pressured rates downward.

Bottom Line: A welcome week of retreat for rates.

TIPS & TRICKS

Are Sellers Really Required to Pay VA Fees?

Realtors often believe sellers are required to pay certain fees for VA loans, like escrow or underwriting. But did you know veterans can pay these fees as long as they fit within the VA’s 1% rule?

The truth is that sellers aren’t automatically responsible for these costs unless it’s negotiated in the contract. Understanding this can save your transactions from unnecessary confusion!

👉 Read the full breakdown here to learn how the VA guidelines really work and debunk this common myth.

TECHNICALS

Momentum Building

-

🏠 Existing Home Sales Surge: December sales rose 2.2% MoM and 9.3% YoY, hitting a 10-month high. Tight inventory (+16.2% YoY) continues to drive home price appreciation.

-

📉 Rental Trends Ease Inflation: Real-time rental data suggests softer inflation ahead, which could lead to lower mortgage rates in the coming months.

-

💼 Slower Hiring Signals a Shift: Rising jobless claims indicate slower hiring, which might cool buyer demand and ease wage-driven rate pressures.

-

📅 This Week’s Must-Watch: Fed rate decision, new housing data, and the PCE inflation report could bring rate volatility—stay tuned! 🚀

🔮 What’s Coming This Week?

Stay tuned for major housing and economic updates:

-

📊 Fed Meeting (Rate decision: Wednesday)

-

🏠 December New and Pending Home Sales

-

💵 Inflation Report (PCE) (Friday)

-

🧮 Q4 GDP Reading