Understanding the Hidden Costs of Mello-Roos Taxes: What Every Homebuyer Should Know Before Closing

💸 PCE Looming

Issue 111 – Hello and Happy Tuesday.

There is a little movement in the rate department, but nothing Earth-shattering.

Friday’s PCE (Personal Consumption Expenditures) will be a big factor in where rates could end up heading into April.

Personal Note:

Back to the grind with the kids, one got sick over this past weekend, so that is always fun trying to avoid them from sneezing directly at your face… lol

I had a few house projects hanging around that I wanted to get done, including some additional lighting in the front of the house, specifically to light up our flag.

Thankfully, I had previously run the 12v wiring under the deck, so this was just hooking it up and fine-tuning the fit of the light into the step.

TLDR (Too Long Didn’t Read) Summary

-

⬆️ RATES – Slight bump upward.

-

🏡 TECHNICALS – Hidden costs with CA new builds.

-

📊 TECHNICALS – Inflation cooling.

INTEREST RATES

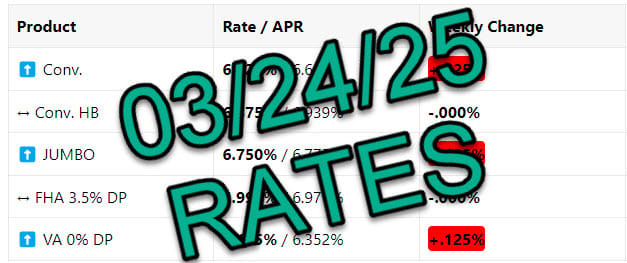

Rates 📢 March 25th, 2025

10 year 3-Month Snapshot

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

⬆️ Conv. |

6.625% / 6.653% |

+.125% |

|

↔️ Conv. HB |

6.875% / 6.939% |

-.000% |

|

⬆️ JUMBO |

6.750% / 6.772% |

+.125% |

|

↔️ FHA 3.5% DP |

5.999% / 6.971% |

-.000% |

|

⬆️ VA 0% DP |

6.125% / 6.352% |

+.125% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates are up because investors are selling bonds, pushing yields higher.

Why? Money is shifting into riskier assets (stocks/crypto) as inflation concerns rise.

What’s next? Friday’s PCE inflation report is key—if it’s hotter than expected, rates could climb further. If it cools, we might see some relief.

Bottom line: Volatility continues. Watch Friday’s inflation data for the next move! 📊

TECHNICALS

Understanding Mello-Roos Taxes

Buying a home is an exciting milestone, but many buyers are caught off guard by unexpected costs beyond the purchase price and mortgage payment. One of the most overlooked expenses is Mello-Roos taxes—a special tax that can significantly impact your monthly housing costs.

What Are Mello-Roos Taxes?

Mello-Roos taxes are special assessments imposed on homes within designated Community Facilities Districts (CFDs). Established under the Mello-Roos Community Facilities Act of 1982 in California, these taxes help fund public infrastructure and services such as:

-

Schools

-

Roads and transportation improvements

-

Parks and recreational facilities

-

Police and fire protection services

-

Water, sewage, and drainage systems

These taxes are common in newer communities where cities or counties need additional funds for essential infrastructure. Instead of using general taxpayer dollars, developers pass these costs onto homeowners through Mello-Roos assessments.

TECHNICALS

Fed Holds, Housing Surprises!

The Fed held rates steady, but housing shocked everyone with stronger-than-expected sales. Meanwhile, builders are losing confidence, and consumer spending is slowing. Here’s what you need to know:

📌 Key Takeaways:

✅ Fed Holds Rates – No change, but two cuts are expected later this year.

✅ Home Sales Jump 4.2% – Buyers are active despite high rates.

✅ Builder Confidence Drops – Costs, regulations, and uncertainty are weighing on sentiment.

✅ Housing Starts Rebound – A strong recovery after January’s weather disruptions.

✅ Retail Sales Lag – Consumers are pulling back, raising recession concerns.

✅ Unemployment Claims Rise Slightly – Signs of a softening job market.

🔥 What’s Coming This Week?

🏡 Tuesday: Home price appreciation & new home sales.

📉 Thursday: Pending home sales & jobless claims.

📊 Friday: The Fed’s favorite inflation report – PCE Index.

Share GTG Weekly with colleagues and earn access to exclusive Monday morning rate updates directly to your inbox. Stay ahead of the curve!