Mortgage Rates Ease ⬇️, Rocket To Purchase Mr. Cooper, Decades Party, Inflation Close But No Cigar.

💸Ghost of Christmas Past

Issue 99 – Good Morning and Happy Tuesday.

It’s jobs week. The BLS (Bureau of Labor Statistics) report will come out on Friday. This will be important because if it shows a ton of people with new jobs, this could lead to inflation. Inflation leads to the Fed not cutting rates… which indirectly leads to higher mortgage rates.

Either way, the numbers are usual BS anyway. They will revise them later down the line, so prepare for knee-jerk reactions.

Star Wars: Episode I – The Phantom Menace, 1999, 20th Century Studios – via Tenor

Personal note: Next week is the 100th issue of GTG Weekly. Pretty cool. I’ll make sure pat myself on the back for everyone.

Qualify Leads Instantly with AI

Don’t let slow lead qualification cost you deals. Synthflow AI voice agents qualify and follow up on mortgage leads instantly, ensuring no opportunity is missed. With real-time responses and CRM integration, you can focus on what matters most—closing deals. Start your free trial today and see the impact on your efficiency.

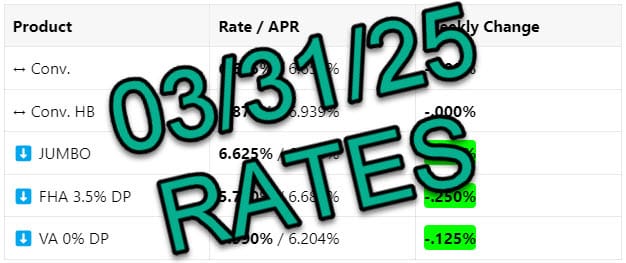

INTEREST RATES

Rates 📢 December 3rd, 2024

10 year 3-Month Snapshot

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

⬇️ Conv. |

6.625% / 6.642% |

-.250% |

|

↔️ Conv. HB |

6.999% / 7.017% |

-.000% |

|

⬇️ JUMBO |

6.750% / 6.759% |

-.125% |

|

⬇️ FHA 3.5% DP |

6.000% / 6.924% |

-.125% |

|

⬇️ VA 0% DP |

6.000% / 6.213% |

-.125% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: All rates are moving downward after last week’s PCE data came in as expected.

Bottom Line: This is similar to last year when we saw favorable rates, but ONLY for a short window over December. This is NOT a time to sleep on lower rates!!

Back to the Future Part II, Universal Pictures 1989 – via Tenor

Rates this time last year. Look familiar??

INDUSTRY

Credit Report Costs Skyrocket

The Office, NBC – via Tenor

🚨 Credit Report Costs Set to Surge in 2025 – Here’s What It Means for You!

In breaking news for the mortgage industry, credit report costs are projected to rise significantly in 2025—by as much as 40%! At GTG, our average 3-bureau credit report currently costs around $72, but if these increases hold, we could be looking at costs north of $100 per report.

🔍 Why Are Costs Rising?

This isn’t the first time we’ve seen hikes like this. In fact, credit report costs have been steadily climbing over the past few years due to changes made by FICO and the three major credit bureaus…

TECHNICALS

Inflation & Inventory…

📊 Inflation Update: Core PCE rose to 2.8% year-over-year, keeping pressure on mortgage rates for now. Lower comparisons in 2024 could ease rates.

-

🏗️ New Home Sales Drop: Sales fell 17.3% in October due to hurricanes and higher rates. Inventory remains tight with limited completed homes available.

-

📈 Pending Home Sales Up: Signed contracts rose 2% month-over-month and 5.4% year-over-year, showing growing buyer momentum.

-

🏡 Home Prices at Record Highs: Prices increased 3.9% annually, marking 16 straight months of record highs. Limited supply continues to support appreciation.

-

💼 Labor Market Mixed: Initial unemployment claims hit a 7-month low, but 1.9 million people remain on Continuing Claims, signaling slower hiring.

Key Takeaway: Despite challenges, buyer demand is growing, and tight inventory supports strong pricing. Encourage clients to act now before market conditions shift.