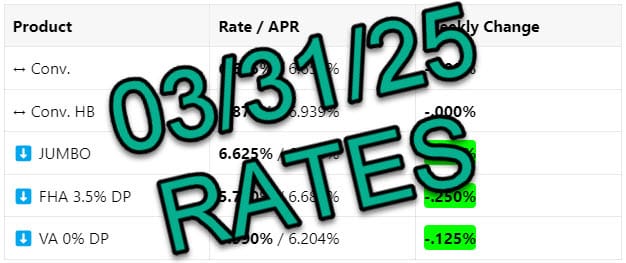

Mortgage Rates Ease ⬇️, Rocket To Purchase Mr. Cooper, Decades Party, Inflation Close But No Cigar.

How to Prepare Financially for Buying a Home in the New Year

As the New Year approaches, many people set resolutions to achieve major life goals—and buying a home often tops the list. If you’re planning to purchase a home in the coming year, taking steps now to prepare financially can make the process smoother and more rewarding. Here are some key tips to help you get ready.

1. Review Your Credit Score

Your credit score plays a major role in determining your mortgage eligibility and interest rate. Start by checking your credit report for any errors or inconsistencies that might be hurting your score. If your score is lower than you’d like, focus on paying down existing debt, making all payments on time, and avoiding new credit inquiries.

2. Build or Strengthen Your Savings

Saving for a down payment and closing costs is one of the most significant financial hurdles for homebuyers. Aim to save at least 5-20% of the home’s price for the down payment, depending on the loan type, and an additional 2-5% for closing costs. Consider setting up a dedicated savings account to make your goal more achievable.

3. Get Pre-Approved

Getting pre-approved for a mortgage gives you a clear picture of how much home you can afford and demonstrates to sellers that you’re a serious buyer. A mortgage professional can walk you through this process and help you understand your loan options.

4. Evaluate Your Budget

Take a close look at your income, monthly expenses, and overall debt-to-income ratio (DTI). Lenders typically prefer a DTI below 43%, so if your debts are too high, consider paying down credit cards, car loans, or other obligations before applying for a mortgage.

5. Plan for Additional Costs

Owning a home comes with expenses beyond the mortgage payment, such as property taxes, insurance, maintenance, and utilities. Build these costs into your budget now to avoid surprises later.

Start the Year with Confidence

By taking these steps, you’ll position yourself for success in the home-buying process. A little financial preparation now can make all the difference in achieving your dream of homeownership in the New Year. If you’re ready to get started, reach out to a mortgage professional today!