Mortgage Rates Ease ⬇️, Rocket To Purchase Mr. Cooper, Decades Party, Inflation Close But No Cigar.

Mortgage Rates 📢 December 16th, 2024

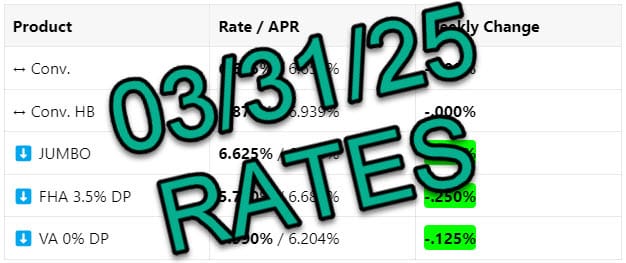

INTEREST RATES

10 year 3-Month Snapshot

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

⬆️ Conv. |

6.875% / 6.889% |

+.375% |

|

⬆️ Conv. HB |

6.875% / 6.885% |

+.250% |

|

⬆️ JUMBO |

6.875% / 6.884% |

+.250% |

|

⬆️ FHA 3.5% DP |

6.125% / 7.052% |

+.375% |

|

⬆️ VA 0% DP |

6.125% / 6.339% |

+.375% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: Bond markets are feeling the pressure from the looming Fed Meeting on Wednesday. Yes, another 25bp (1/4 percent) cut is expected. But remember, this is the Fed Funds Rate, and although it can trend with mortgage rates, they are separate!

We had a rough go of it last week. Inflation readings came in slightly higher than expected and each day saw a bit more deterioration than the one before. The result is that week over week, we have lost a quarter to 3/8ths in rates.

Bottom Line: We did not want to see the trend reversal. This could put some buyers and sellers into a “long winter’s nap” for the next few weeks!