Mortgage Rates Ease ⬇️, Rocket To Purchase Mr. Cooper, Decades Party, Inflation Close But No Cigar.

Mortgage Rates 📢 December 2nd, 2024

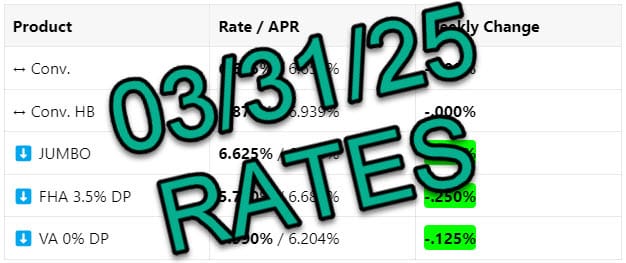

INTEREST RATES

10 year 3-Month Snapshot

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

⬇️ Conv. |

6.625% / 6.642% |

-.250% |

|

↔️ Conv. HB |

6.999% / 7.017% |

-.000% |

|

⬇️ JUMBO |

6.750% / 6.759% |

-.125% |

|

⬇️ FHA 3.5% DP |

6.000% / 6.924% |

-.125% |

|

⬇️ VA 0% DP |

6.000% / 6.213% |

-.125% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: All rates are moving downward after last week’s PCE data came in as expected.

Bottom Line: This is similar to last year when we saw favorable rates, but ONLY for a short window over December. This is NOT a time to sleep on lower rates!!