Mortgage Rates Ease ⬇️, Rocket To Purchase Mr. Cooper, Decades Party, Inflation Close But No Cigar.

Mortgage Rates 📢 January 13th, 2025

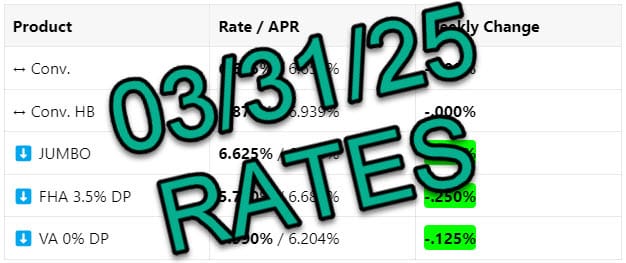

INTEREST RATES

10 year 3-Month Snapshot

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

⬆️ Conv. |

7.250% / 7.301% |

+.250% |

|

⬆️ Conv. HB |

7.375% / 7.419% |

+.125% |

|

⬆️ JUMBO |

6.875% / 6.914% |

+.125% |

|

⬆️ FHA 3.5% DP |

6.375% / 7.346% |

+.125% |

|

⬆️ VA 0% DP |

6.625% / 6.877% |

+.375% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: These rates are taking us for a ride and not a fun one.

Bottom Line: This week’s key focus is inflation:

-

Producer Price Index (PPI): This measures wholesale inflation. It’s expected to rise slightly, from 3% to 3.4% annually. Don’t worry too much; PPI has less impact on the housing market than other metrics.

-

Consumer Price Index (CPI): The more important metric for us. It tracks everyday price changes and is expected to rise slightly from 2.7% to 2.8% annually. The “core” CPI, which excludes volatile items like food and energy, should hold steady at 3.3%.

-

Shelter Costs: These make up a huge portion (46%) of CPI. The good news? Shelter inflation is finally cooling down, which could stabilize overall CPI.

-

Why it matters: If inflation steadies, interest rates could follow.