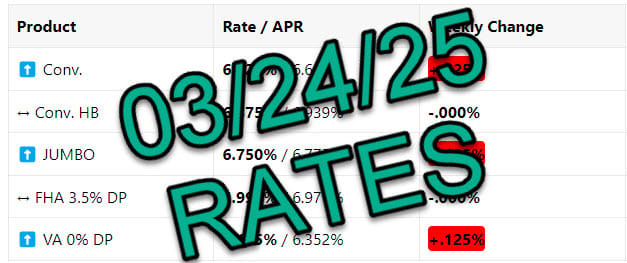

Mortgage Rates Tick Up ⬆️, Home Projects, Hidden Costs of New Builds, Fed Holds Fed Funds Rate.

The Hidden Cost of Buying a New Home

TECHNICALS

Understanding Mello-Roos Taxes

Buying a home is an exciting milestone, but many buyers are caught off guard by unexpected costs beyond the purchase price and mortgage payment. One of the most overlooked expenses is Mello-Roos taxes—a special tax that can significantly impact your monthly housing costs.

What Are Mello-Roos Taxes?

Mello-Roos taxes are special assessments imposed on homes within designated Community Facilities Districts (CFDs). Established under the Mello-Roos Community Facilities Act of 1982 in California, these taxes help fund public infrastructure and services such as:

-

Schools

-

Roads and transportation improvements

-

Parks and recreational facilities

-

Police and fire protection services

-

Water, sewage, and drainage systems

These taxes are common in newer communities where cities or counties need additional funds for essential infrastructure. Instead of using general taxpayer dollars, developers pass these costs onto homeowners through Mello-Roos assessments.

Why Are Mello-Roos Taxes a Hidden Cost?

Unlike traditional property taxes, which are typically around 1.25% of a home’s value, Mello-Roos taxes are an additional charge that varies by community. They are not always prominently disclosed in a home’s listing price, making them an unexpected financial burden for many buyers.

Here’s why Mello-Roos taxes can be a surprise:

-

They Are in Addition to Standard Property Taxes – If you’re budgeting for a 1.25% tax rate, a Mello-Roos district can push your total tax rate closer to 2%.

-

They Can Last for Decades – Some Mello-Roos assessments expire after 20-40 years, while others may be extended or renewed.

-

They Can Significantly Increase Your Monthly Payment – Higher property tax bills mean larger escrow payments, which directly impact affordability and mortgage qualification.

Example: How Mello-Roos Affects Your Payment on an $850,000 Home

To put the cost into perspective, let’s compare an $850,000 home with and without Mello-Roos taxes.

-

Without Mello-Roos: Standard property tax rate of 1.25% results in an annual tax bill of $10,625, or about $885 per month.

-

With Mello-Roos: The total tax rate increases to 2%, resulting in an annual tax bill of $17,000, or about $1,416 per month.

-

Monthly Difference: A Mello-Roos assessment adds an extra $531 per month to your housing costs.

For many buyers, this additional expense can affect loan approval, overall affordability, and long-term budgeting.

How to Find Out If a Home Has Mello-Roos Taxes

Before purchasing a home, take these steps to determine if Mello-Roos taxes apply:

-

Check the Property’s Tax Bill – Mello-Roos assessments are listed as a separate line item.

-

Ask Your Real Estate Agent – Your agent should be able to confirm whether a home is in a Mello-Roos district.

-

Ask Your Mortgage Professional – Lenders and mortgage professionals can help estimate the total tax burden and how it affects your monthly payment.

-

Review the Preliminary Title Report – This document will indicate if the property is subject to Mello-Roos assessments.

Are Mello-Roos Taxes Worth It?

While Mello-Roos taxes increase costs, they also fund high-quality schools, parks, and public services that can enhance property values and community appeal. However, it’s important to weigh these benefits against the added expense to determine if a home in a Mello-Roos district aligns with your budget and financial goals.

Final Thoughts

Understanding Mello-Roos taxes is essential for making an informed home purchase. Before committing to a property, ensure you account for all costs—including these special assessments—to avoid any financial surprises after closing.

If you have questions about Mello-Roos taxes or need guidance on financing a home, GTG Financial is here to help!