💸 GTG’s Next Phase

Issue 108 – Good Morning and Happy Tuesday.

For the past couple of weeks, there has been an unannounced blackout. I apologize for this, and thank you to those who contacted us to ask what was going on.

We’ve been hard at work behind the scenes and are excited for the next phase of GTG Financial’s direction.

The mortgage and Real Estate industries continue to evolve with significant advancements in technology—particularly with the growing use of artificial intelligence (AI). To remain competitive and better serve our clients, we’ve spent the past several months exploring the best path forward for both our team and the people we serve.

After careful consideration and planning, over the next 120 to 180 days, GTG Financial will be merging with another brokerage, Be My Neighbor Mortgage (BMN) under the ownership of ReAlpha Tech Corp, a publicly traded company focused on technological innovation and growth.

What does this mean for you as a valued real estate partner?

✅ Same trusted team, enhanced capabilities – You’ll continue working with the same professionals, now backed by even more resources to help you close deals efficiently.

✅ Expanded lending solutions – More loan products, competitive options, and creative financing solutions to meet your clients’ unique needs.

✅ Referral integrity & transparency – While our structure is evolving, our referral relationships remain unchanged—there is a strict separation between our lending operations and any affiliated real estate transactions to ensure transparency, compliance, and trust.

✅ Streamlined processes with AI-driven efficiency – Faster turn times, smoother closings, and more support to help you grow your business.

Billions, Showtime via Tenor

While the industry is shifting, our commitment to supporting you and your clients remains unchanged. This transition strengthens our ability to serve you, not replace it.

If you have any questions about how this enhances your business, let’s connect. We look forward to working together as we take mortgage lending to the next level—with the right technology, the right team, and the right partnerships.

TLDR (Too Long Didn’t Read) Summary

-

⬇️ RATES – Break lower as PCE comes in on target.

-

📊 INDUSTRY – Pending home sales drop, prices climb.

INTEREST RATES

Rates 📢 March 4th, 2025

10 year 3-Month Snapshot

|

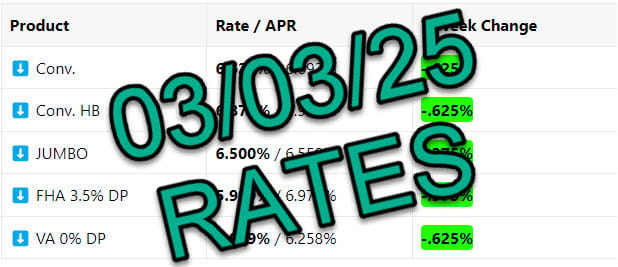

Product |

Rate / APR |

7 Week Change |

|---|---|---|

|

⬇️ Conv. |

6.625% / 6.692% |

-.625% |

|

⬇️ Conv. HB |

6.875% / 6.939% |

-.625% |

|

⬇️ JUMBO |

6.500% / 6.558% |

-.375% |

|

⬇️ FHA 3.5% DP |

5.999% / 6.971% |

-.375% |

|

⬇️ VA 0% DP |

5.999% / 6.258% |

-.625% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: We’re approaching what could be the perfect storm, in a good way. If rates continue this downward run, right into the teeth of Spring buying season, we could see fireworks.

Bottom Line: Trending in the right direction!

📉 Rates & Bonds: Mortgage rates have dipped about 0.5% over the last month as bonds rallied. However, bonds are now testing resistance, and further improvement may be limited unless yields drop below 4.126%.

📊 Economic Signals: The Atlanta Fed sharply cut Q1 GDP forecasts from 2.9% to 1.5%, signaling a slowing economy. If this trend continues, the Fed may shift toward rate cuts, which could further help mortgage rates.

🏠 Housing Market: Realtor.com reports days on market dropped 10% in February, indicating stronger buyer demand as we head into spring. However, rising home prices and still-elevated rates mean affordability remains a challenge.

🔎 Watch This Week: The BLS Jobs Report on Friday is the key event—job growth expectations are between 140-150K, with unemployment expected to hold at 4%. A weak report could push rates lower.

Here’s why workplace life insurance might not be enough

Unexpected events shouldn’t leave your loved ones financially exposed. And while employer coverage is a nice perk, it usually only offers 2x your salary – far below the recommended 10-15x for real security (especially with dependents). Term life insurance can bridge the gap with customizable, affordable plans. Money’s Best Life Insurance list can help you find coverage starting at just $7/month, providing the peace of mind your family deserves.

TECHNICALS

Inflation Meets Estimates

The Federal Reserve’s preferred inflation gauge met expectations in January, while home sales showed signs of struggle. Despite this, prices continued to climb across much of the country. Let’s break it all down.

📊 Inflation: Slow Progress, but Progress Nonetheless

The Personal Consumption Expenditures (PCE) Index, the Fed’s go-to inflation measure, landed right on target last month:

✔️ Headline inflation rose 0.3% month-over-month, bringing the annual rate down to 2.5% (from 2.6%).

✔️ Core PCE (excluding food & energy) also ticked up 0.3% for the month, with the yearly rate dropping from 2.9% to 2.6%—one of the lowest levels in four years.

💡 What it means for real estate:

The cost of shelter makes up 18% of Core PCE, and its weight in inflation reports has remained high. However, rental trends from platforms like Apartment List & CoreLogic suggest the Fed’s data may soon catch up to softer real-time rent figures. As that happens, inflation could ease further, making rate cuts more likely.

📝 Pending Home Sales Drop to Record Low

The Pending Home Sales Index (a leading indicator of future closings) dropped 4.6% from December to January, reaching its lowest point on record.

✔️ What’s to blame? High mortgage rates and affordability challenges.

✔️ What’s next? NAR Chief Economist Lawrence Yun expects sales to pick up if mortgage rates ease, as rising incomes and job growth support demand.

💡 What it means for real estate:

Many buyers are waiting on the sidelines for rates to drop. Even a slight decline could reignite demand and create urgency in the market.

📈 Home Prices Continue Their Climb

The Case-Shiller Home Price Index (the gold standard for home value tracking) revealed:

✔️ Home prices rose 0.5% from November to December (seasonally adjusted).

✔️ Prices are up 3.9% year-over-year—a slight increase from November’s 3.7%.

✔️ Major urban markets saw even stronger growth:

-

10-city index: +5.1% YoY

-

20-city index: +4.5% YoY

The FHFA House Price Index, which focuses on homes financed with conventional loans, showed a similar 0.4% monthly increase, with a 4.7% yearly gain.

💡 What it means for real estate:

✔️ Homeowners continue to build significant equity—a $600,000 home appreciating 4% annually equals a $24,000 gain.

✔️ Despite affordability concerns, housing remains a wealth-building vehicle.

📌 Other Key Economic Updates:

✔️ GDP Growth: The U.S. economy expanded 2.3% in Q4 2024, supported by government & consumer spending but held back by slowing investment.

✔️ Unemployment: Initial jobless claims rose to 242K (highest since December), while continuing claims remain above 1.8M for the 38th straight week—a sign that some job seekers are struggling to find new employment.

🔮 What’s Next?

This week’s key reports include:

📊 Private payroll data (Wednesday)

📊 Weekly jobless claims (Thursday)

📊 Non-farm payrolls & unemployment rate (Friday)

Share GTG Weekly with colleagues and earn access to exclusive Monday morning rate updates directly to your inbox. Stay ahead of the curve!