Mortgage Rates Ease ⬇️, Rocket To Purchase Mr. Cooper, Decades Party, Inflation Close But No Cigar.

💸 Spooky High Rates

Issue 94 – Good Morning and Happy Tuesday.

I’ve been told not to be so pessimistic about the markets, but the subject line was just too good not to use, lol.

Here is the good news: the weather has been phenomenal. Rates, not so much. We have now fully unwound all the gains we saw from July onward.

10-Year T Note June through October 21st 2024

We are watching the markets unravel ahead of the election. My speculation is that we could see a reversal the week of November 11th (shout out Veterans Day).

Election chaos will be behind us, the Fed meeting on the 7th will be over, and we can move on.

Here’s to hoping for a whiplash trend reversal that has us all hollering that there is still time to make 2024 a winning year!

Personal note:

Another busy week and weekend. Our lender panel was last Friday, really fun to share some thoughts with several other excellent speakers.

The boys helped Oma with Halloween preparations and smoked themselves out as a result.

We also went to our first floating pumpkin patch at Ridgeway Swim Center, that was a lot of fun!

The boys are helping Oma prep for Halloween!

The Lender Panel was great!

|

Dive for pumpkins on Saturday

|

INTEREST RATES

Rates 📢 October 22th, 2024

10-Year-Treasury 30-Day Snapshot

|

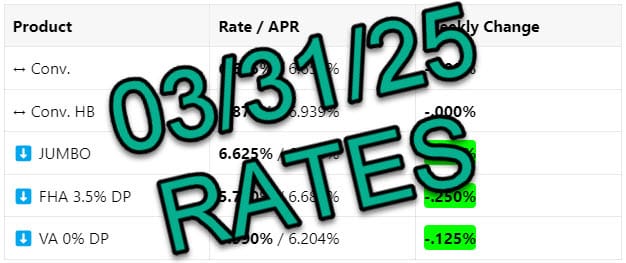

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

⬆️ Conv. |

6.875% / 6.889% |

+.250% |

|

⬆️ Conv. HB |

7.125% / 7.136% |

+.125% |

|

⬆️ JUMBO |

6.750% / 6.764% |

+.125% |

|

⬆️ FHA 3.5% DP |

6.000% / 6.930% |

+.250% |

|

⬆️ VA 0% DP |

6.000% / 6.221% |

+.250% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: Once again, all rates have increased since last week.

Bottom Line: For unknown reasons, bonds have gone up in the first three weeks of October in the past 3 years, followed by a decline. We are keeping our fingers crossed that this trend continues… starting this week, but likely not until after the election.

TECHNICALS

Builders Confidence… Is Building

-

🏗️ Home Builder Confidence Up: NAHB Housing Market Index rose to 43, signaling builders are feeling more positive for 2025, though still below the magic number 50 (expansion).

-

📉 New Construction Slows: Single-family builds are up slightly, but multifamily is dragging down overall construction. Completions also slowed.

-

🛍️ Retail Sales Surged: September retail sales beat estimates, with core sales up 0.7%. Holiday shopping could boost the economy even more.

-

📉 Jobless Claims Show Weakness: Jobless claims fell, but ongoing claims rose to the highest level since July—hinting at a slowdown in hiring.

-

📅 What’s Ahead: Watch out for updates on Existing Home Sales (Wednesday) and New Home Sales (Thursday), along with fresh Jobless Claims data.