Mortgage Rates ⬆️ up. Markets are all over the place. Need strong inflation data this week to see rates move downward.

💸Markets Shift Ahead of CPI

Issue 97 – Good Morning and Happy Tuesday.

Crazy week… Election results, Fed meetings, and monster market movements—oh my! This is not a political newsletter. We will not discuss all that unless it directly affects rates or our industry.

There will be no “Sneak Peek Rates” or a newsletter next week. I have a business engagement taking me out of state next week that will require my full attention.

That being said, I will mention the stock and Crypto markets here. Holy smokes, these markets are really liking the election results.

🚀 To the moooooon!

Click this shameless plug if you want to check Coinbase for Crypto trading.

Personal note: There is not a ton to report this week. It was a quiet weekend. We took Monday off for Veterans Day.

On a fun note, though, we were able to take inventory of the Toys for Tots haul we collected from the Oktoberfest party.

Thank you to everyone who attended the party and contributed to the toy drive!

Toys for Tots!

The Real Estate Professional’s Secret Weapon – Land id™

-

Discover extensive nationwide private parcel & ownership data

-

Create & share powerful, interactive maps of any property

-

Mobile Apps: Find property data on the go

INTEREST RATES

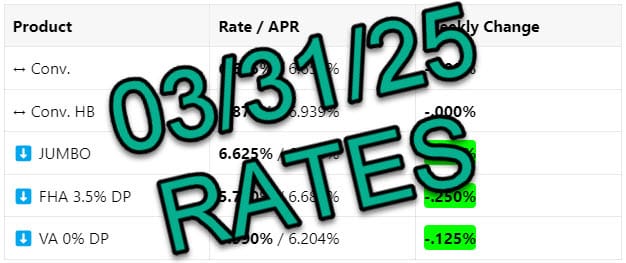

Rates 📢 November 12th, 2024

10Y Treasury 90 Day View

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

↔️ Conv. |

6.999% / 7.014% |

-.000% |

|

↔️ Conv. HB |

7.125% / 7.136% |

+.000% |

|

⬇️ JUMBO |

7.000% / 7.009% |

-.125% |

|

⬆️ FHA 3.5% DP |

6.125% / 7.050% |

+.125% |

|

↔️ VA 0% DP |

6.125% / 6.342% |

+.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: Bond markets were closed on Monday, and the stock market was open.

Bottom Line: Everything is bracing for CPI numbers being issued tomorrow.

TECHNICALS

Feds Cut (non-mortgage) Rates

The Fed just cut rates again, home prices are still inching up, and jobless claims are showing some changes. Here’s the scoop on what’s going on in the market:

🚀 Fed Cuts Rates by 25 Basis Points

The Federal Reserve reduced their benchmark Federal Funds Rate by another 0.25%, setting it at a range of 4.5% to 4.75%. While this isn’t directly tied to mortgage rates, it impacts the broader rate environment. Essentially, it’s the rate banks use to lend money to each other overnight – the foundation for interest rates overall.

Why does this matter?

The Fed’s continued cuts suggest they’re comfortable with inflation progress and employment stability, despite the ongoing economic challenges. Inflation might still feel sticky, but the Fed Chair, Jerome Powell, highlighted that recent trends show it moving closer to the target range of 2%. This could influence mortgage rates down the road, potentially affecting affordability for buyers.

🏡 Understanding Seasonal Housing and Appreciation Trends

📈 September Home Price Trends:

-

Home prices ticked up by 0.02% in September and are 3.4% higher than this time last year.

-

Forecasts suggest a slight 0.1% dip in October but expect an overall 2.3% rise next year.

🤔 Why should agents care?

Autumn is typically a slower season, with fewer buyers competing. Despite that, prices are holding steady, and this points to ongoing wealth-building opportunities through homeownership. Families often avoid moving in the middle of a school year, meaning less competition for buyers in the market now – a great point to share with motivated clients.

💡 Continuing Jobless Claims Hit a 3-Year High

📅 Unemployment Trends:

-

Initial unemployment claims rose slightly to 221,000.

-

Continuing Claims jumped by 39,000 to reach 1.89 million, the highest since late 2021.

What’s the bottom line?

While initial claims are still low, the rise in continuing claims means people are staying on unemployment longer. Companies seem to be slowing down hiring rather than starting massive layoffs – this is something to watch as we look for signs of change in the labor market.

📜 What to Look for This Week

Keep an eye out for key updates on inflation: Consumer Price Index (Wednesday) and Producer Price Index (Thursday) are dropping this week. Plus, October Retail Sales data is coming Friday – these reports will give more clues about spending trends and where we’re headed.