Buying a home is an exciting journey, but it comes with its share of expenses—one…

💸Calm Before The Storm

Issue 96 – Good Morning and Happy Tuesday.

Well, we’re here. Election Day.

How will the markets react? I think we might know sooner than we think. I saw this in the Morning Brew yesterday. Nearly half of the 2020 Electorate have already cast their vote!

Saturday Night Live, 2000 – NBC, via Tenor

For those of you who participated in our poll last week, we had a split vote of –

Rates will stay the same vs Rates will go down.

Personal note:

Halloween was great on Thursday. Kids learned the lesson that “the more candy you gather, the heavier your bag gets, and you’re far from the house.” Watching them lug pillowcases full of candy and complaining was funny.

We headed out to the beach again this weekend. This time, Wrights Beach.

Grayson was flying the F-22 kite, and the wind was RIPPING!

Grayson started a nice hole in the sand.

Mark (King Trident), Angie (Ursula), Brooke (Ariel), Heather (Flounder) & Elise (Wicked Witch of the West)

|

JJ found some great treasures.

Glenn (Jedi Master), Grayson (Storm Trooper), JJ (Police Officer), Jamie (Robber)

|

2 Cards Charging 0% Interest Until 2026

Paying down your credit card balance can be tough with the majority of your payment going to interest. Avoid interest charges for up to 18 months with these cards.

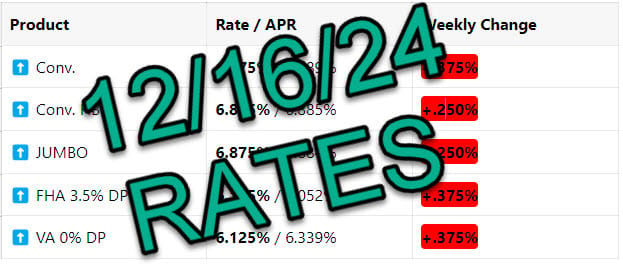

INTEREST RATES

Rates 📢 November 5th, 2024

Saturday Night Live, Weekly Update – NBC via Tenor

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

↔️ Conv. |

6.999% / 7.005% |

+000% |

|

↔️ Conv. HB |

7.125% / 7.136% |

+.000% |

|

⬆️ JUMBO |

7.125% / 7.134% |

+.125% |

|

⬇️ FHA 3.5% DP |

6.000% / 6.924% |

-.250% |

|

↔️ VA 0% DP |

6.125% / 6.342% |

+.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: Rates have stopped their march upward. It’s the calm before the storm. The election is today, and the Fed meeting is Thursday. Reminder: Fed Funds rate cuts are NOT mortgage rate cuts!

Bottom Line: Get ready for volatility. We don’t know how the market will react to either candidate’s declared victory.

TECHNICALS

Election and Then Fed Meeting

October brought mixed news, with slowing job growth, promising signs on inflation, and a strong rebound in pending home sales. Here’s the quick rundown:

💼 Job Growth Stalls

-

Only 12,000 new jobs were created, well below forecasts. Small businesses especially struggled, adding just 4,000 jobs.

📉 Labor Market Weakness

-

Job openings fell to 7.443 million, and fewer people are quitting, showing less confidence in job security.

📊 Inflation Progress

-

Core PCE inflation remains steady, close to the Fed’s 2% target. Cooler inflation may mean fewer rate hikes ahead, which could help mortgage rates.

🏡 Pending Home Sales Surge

-

Signed contracts rose 7.4% from August to September, driven by lower late-summer rates and more inventory options.

📈 Home Prices Hit Another High

-

Home prices rose 0.3% from July to August, marking a record 15 months of growth. Home values are up 4.2% from last year.

📉 Q3 GDP Below Forecasts

-

Economic growth came in at 2.8%, softer than expected, which could influence the Fed’s future rate decisions.

📅 This Week

-

Fed Meeting: Insights into future rate policy could impact mortgage rates.

-

Home Price Data: See if price appreciation continues its upward trend.

-

Jobless Claims: More data on the cooling labor market.