Mortgage Rates Ease ⬇️, Rocket To Purchase Mr. Cooper, Decades Party, Inflation Close But No Cigar.

💸 Hauntingly High Rates, What Will Happen Next Week?

Issue 95 – Good Morning and Happy Tuesday.

Who else is jacked for this damn election to be over? My goodness, everyone has an opinion, don’t they?

My only interest is figuring out how each candidate will affect the markets. As last week, we hope everyone calms down and the market can let go of the tension that has built up.

The Campaign, 2012 – Warner Brothers, via Tenor

🎃 Halloween is this Thursday, and the kids are super excited. Hopefully, it won’t rain. Don’t worry; we’ll have pictures to share. The day after Halloween should be a day off for school kids, just like the Monday after the Super Bowl should be a national holiday.

Personal note:

We were invited to a birthday party out at Doran Beach. Admittedly, I did not want to go. It was a 40-minute drive, and it was supposed to be cold and overcast; plus, it was just another kid’s party, lol.

Turned out to be a great day. Perfect weather, kids had a blast playing with friends in the dunes and the surf.

Mom and Dad enjoying the sunshine

Grayson got soaked

|

Gerald trying to outrun the surf

|

INTEREST RATES

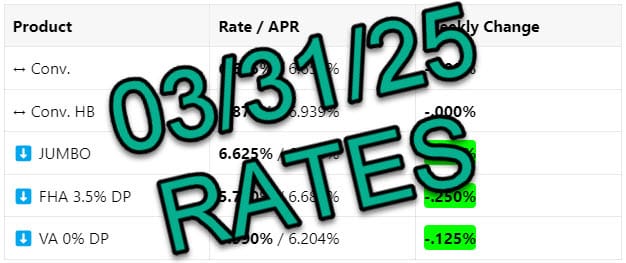

Rates 📢 October 29th, 2024

10-Year-Treasury 30-Day Snapshot

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

⬆️ Conv. |

6.999% / 7.005% |

+.125% |

|

↔️ Conv. HB |

7.125% / 7.136% |

+.000% |

|

⬆️ JUMBO |

7.000% / 7.012% |

+.250% |

|

⬆️ FHA 3.5% DP |

6.250% / 7.178% |

+.250% |

|

⬆️ VA 0% DP |

6.125% / 6.342% |

+.125% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: I’m not kidding. We legitimately lost 1% in rate in the last 42 days.

Well, it looks like I was wrong… it was crazy.

Thursday will see PCE inflation numbers and Friday’s BLS Jobs Report. This could be our last gasp of market reversal before the election 7 days from now. The Fed will also uses these reports to decide what to do with their next meeting in 9 days. Not that any sort of rate cut benefited us last go around, lol. Reminder, Fed Funds rate cuts are NOT mortgage rate cuts!

Bottom Line: Same message as last week. Hold tight. Markets are making knee-jerk reactions leading up to the election. It remains unknown how the markets will react to either candidate winning.

Credit – Erik Browning

TECHNICALS

Jobs + PCE This Week…

-

🔑 Existing Home Sales

-

📉 Sales down 1% from August, 3.5% year-over-year; inventory remains tight.

-

💰 20% of homes sold above list price, showing demand is still strong.

🏗️ New Home Sales

-

📈 Sales up 4.1% in September, highest in over a year.

-

🏠 Only 108,000 of 470,000 new homes for sale are move-in ready.

💼 Jobless Claims

-

📊 Continuing claims at 1.897M, highest since November 2021.

-

🛑 Employers are slowing down their hiring pace.

📉 Economic Outlook

-

📉 Leading Economic Index down for 29 out of the last 30 months.

-

🏦 Beige Book shows economic stagnation across most regions.

-

📅 Upcoming Reports

-

Thursday: 🔍 Personal Consumption Expenditures (PCE)

The Personal Consumption Expenditures (PCE) report is the Fed’s preferred measure of inflation, tracking changes in the prices of goods and services consumed by households. Higher PCE readings suggest that inflation is still an issue, which can influence the Fed’s decisions on interest rates.

💡 Why It Matters:

If inflation remains elevated, the Fed may keep Fed Funds rates higher for longer to control rising prices. This could impact affordability for buyers, slowing demand in the housing market. On the flip side, a lower PCE reading might ease pressure on rates, potentially boosting buyer activity as affordability improves.