Mortgage Rates Ease ⬇️, Rocket To Purchase Mr. Cooper, Decades Party, Inflation Close But No Cigar.

Mortgage Rates 📢 October 21st, 2024

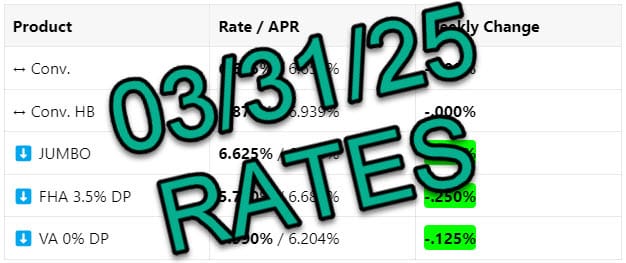

INTEREST RATES

10-Year-Treasury 30-Day Snapshot

|

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

⬆️ Conv. |

6.875% / 6.889% |

+.250% |

|

⬆️ Conv. HB |

7.125% / 7.136% |

+.125% |

|

⬇️ JUMBO |

6.750% / 6.764% |

-.375% |

|

⬆️ FHA 3.5% DP |

6.000% / 6.930% |

+.250% |

|

⬆️ VA 0% DP |

6.000% / 6.221% |

+.250% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: More movement upward for all but JUMBO (typically lags in reaction) financing from last week.

Bottom Line: For unknown reasons, bonds have gone up in the first three weeks of October in the past 3 years, followed by a decline. We are keeping our fingers crossed that this trend continues… starting this week, but likely not until after the election.