Mortgage Rates 📢 October 28th, 2024

INTEREST RATES

10-Year-Treasury 30-Day Snapshot

|

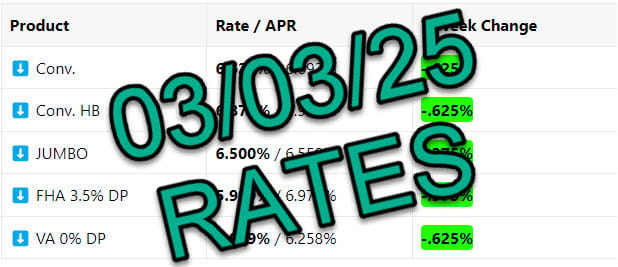

Product |

Rate / APR |

Weekly Change |

|---|---|---|

|

⬆️ Conv. |

6.999% / 7.005% |

+.125% |

|

↔️ Conv. HB |

7.125% / 7.136% |

+.000% |

|

⬆️ JUMBO |

7.000% / 7.012% |

+.250% |

|

⬆️ FHA 3.5% DP |

6.250% / 7.178% |

+.250% |

|

⬆️ VA 0% DP |

6.125% / 6.342% |

+.125% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates: I’m not kidding. We legitimately lost 1% in rate in the last 42 days.

Well, it looks like I was wrong… it was crazy.

Thursday will see PCE inflation numbers and Friday’s BLS Jobs Report. This could be our last gasp of market reversal before the election 8 days from now. The Fed will also uses these reports to decide what to do with their next meeting in 10 days. Not that any sort of rate cut benefited us last go around, lol. Reminder, Fed Funds rate cuts are NOT mortgage rate cuts!

Bottom Line: Same message as last week. Hold tight. Markets are making knee-jerk reactions leading up to the election. It remains unknown how the markets will react to either candidate winning.